+91 40 4203 6601

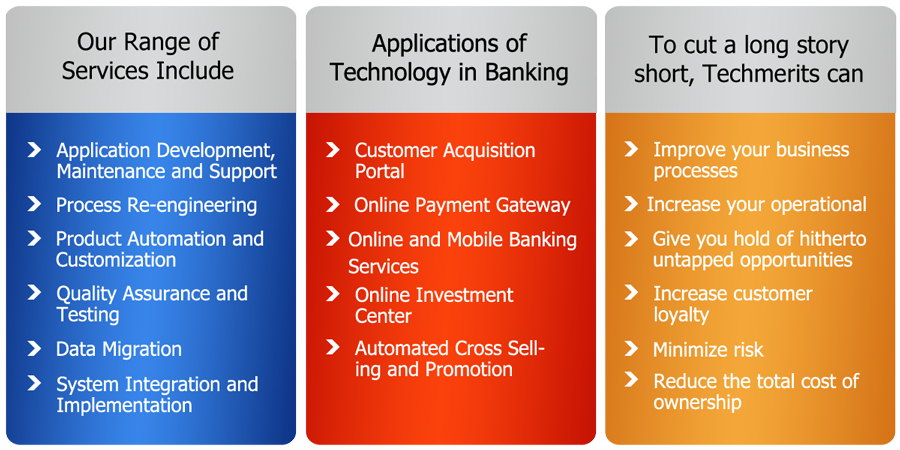

Accordion holds a strong expertise in offering technology solutions and consultancy for the banking industry. We cover almost all banking functions and processes including branch banking, online banking, mobile banking, and everything in-between.

Value for money is at the forefront of our consulting services. Our years of experience in the banking industry and technology solutions enables us to automate the manual processes, and this alone can result in about 50% of cost cutting. Reduction in turnaround time, faster time to market, higher accuracy in operations and improvement in customer service will further add to your savings.

Our domain experts will guide you with their knowledge and empower you with various technological tools to help you manage your business operations in a more efficient manner.

With a wide spectrum of services including deposit accounts, accounting, private banking, debit and credit cards, loans, insurance, portfolio management, risk management, etc., Accordion can completely transform the way you conduct your operations so as to drive more value to your business.

We cover most of the banking segments you can think of; most prominent among them are given below:

Payment/Card ProcessingPayment processing segment is witnessing a rapid evolution due to innovation in technology and ever-changing regulatory framework. Cashless transactions in a highly secure environment yet without giving the slightest hint of uneasiness are becoming the order of the day. Our payment and card processing solutions will help you minimize risk, reduce fraud, acquire new card holders and increase the usage of existing card holders through loyalty points, incentives and other strategies. Our IT solutions will induce high levels of efficiency in your process through:

We understand the high pressure environment the banking industry functions in. Since high amount of risk and capital is involved, you are always under the constant watch of your shareholders, lenders and market regulators. In such a scenario, collection of actionable data, analysis of all of the available options in hand and an ability to assess risk across multiple systems becomes of utmost significance.

Accordion with its whole range of testing, consulting and data management solutions can help you better manage your market and operational risks. While developing IT tools and techniques to enhance your productivity, our experts also keep your data privacy in mind all the while.

As more and more customers are becoming tech savvy, internet and mobile banking is rapidly replacing the traditional channels like branch (and even ATM) banking. Processing transactions through these remote channels needs to be highly secure and based upon multiple levels of authentication.

Accordion offers innovative solutions to meet the challenges of transformational journey due to these evolving trends in banking. We possess sufficient capability to work on both, front end and back end requirements of digitization. We can seamless integrate modern and traditional banking channels to offer a unified experience to customers across different channels.

Functional transparency as well as early and regular progress updates keep Agile practitioners in complete control of the project, including modifications of the project scope as required as well as delivery milestones while maintaining elasticity to finish the project before time, if market conditions allow.

Private BankingOffering personalized and specialized services to high-net-worth individuals adds to the revenue stream by offering cross selling opportunities as well as by helping to retain highly valued customers. But since most of your competitors are already doing the same, you need to differentiate your services and make them more attractive. Our technology services can help you reinvent your private banking products through automation, efficiency, analytics, agility and scalability.

Corporate BankingCorporate customers are the lifeline of the banking industry, a market so huge and significant that several banks solely focus on them. But meeting the diverse needs of your corporate customers - cash, loan, liquidity, security management, etc. - is by no means a small challenge. It calls for access to real-time information (cash position for instance), integrated working of multiple software and systems, efficient CRM, and much more. Accordion can help you simplify the whole process, adding productivity and efficiency down the value chain.

OthersOther segments include loans, lending, insurance, investment, treasury, securities, asset management, etc.

Software and applications for banking services are among the most complicated ones. Consequently, their testing too requires specialized knowledge and training. Since we have a deep domain experience in banking and testing industries, we know what approach to follow and what techniques to apply at various stages of those complex workflows.

We can test all aspects of a banking application or system including:

Efficiency and appropriateness in meeting your requirements

Functional testing

Database testing

Security testing

User experience and acceptance